Utility Bonds

What Is a Utility Bond?

How Do Utility Bonds Work?

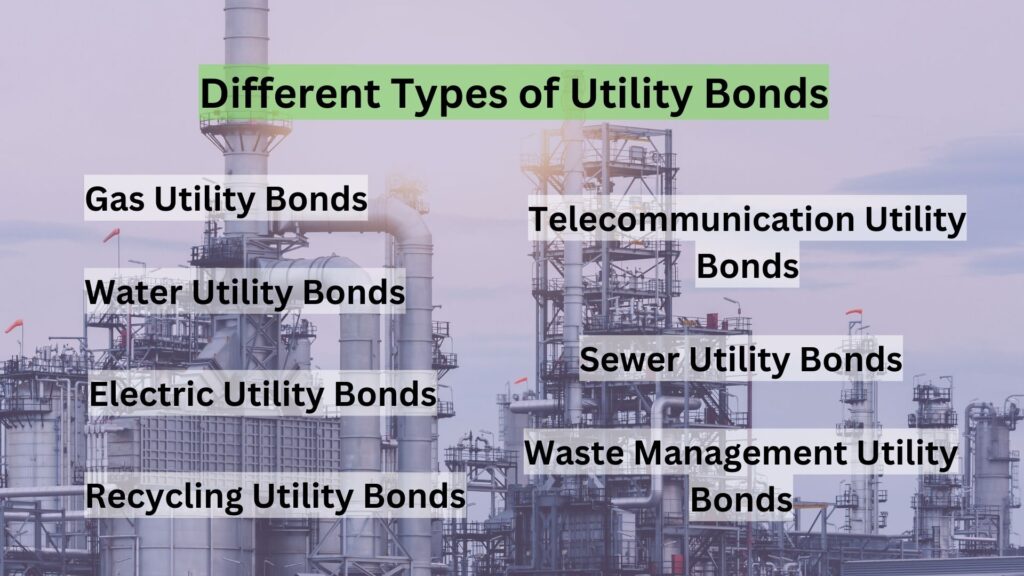

Types of Utility Bond

Gas Utility Bonds

Gas utility bonds are required by natural gas companies from their commercial or residential customers to ensure payment for gas services. These bonds guarantee that customers will pay their gas bills on time and in full.

Water Utility Bonds

Water utility bonds are used by water companies to guarantee payment for water services. These bonds are often required for new commercial developments or when a customer has a history of late payments or non-payment.

Electric Utility Bonds

Electric utility bonds are used by electric companies to secure payment for electricity services provided to customers. These bonds ensure that customers will pay their electricity bills as required.

Telecommunication Utility Bonds

Telecommunication utility bonds are used by phone companies and internet service providers to guarantee payment for communication services. These bonds are typically required for commercial customers or customers with poor credit histories.

Sewer Utility Bonds

Sewer utility bonds are required for new developments or customers with a history of late or non-payment of sewer bills. These bonds ensure that customers will pay for sewer services provided by the utility company.

Waste Management Utility Bonds

Waste management utility bonds are used by waste disposal companies to guarantee payment for waste collection and disposal services. These bonds provide assurance that customers will pay for the waste services they receive.

Recycling Utility Bonds

Recycling utility bonds are required by recycling companies to ensure payment for recycling services provided to customers. These bonds help secure the financial commitment of customers to pay for recycling services.

Benefits of Utility Bonds

Utility bonds offer several benefits to both utility companies and their customers. Some of the key advantages of utility bonds include:

Financial Security for Utility Companies

Utility bonds provide financial security to utility companies by guaranteeing payment for their services. If a customer fails to pay their utility bills, the bond issuer (usually a surety company) becomes responsible for covering the outstanding amounts, ensuring that the utility company still receives payment.

Customer Eligibility

For customers who have a history of late payments or non-payment, utility bonds can serve as a way to demonstrate their financial responsibility. Posting a bond can help customers qualify for utility services that they might not otherwise be eligible for due to their credit history.

Reduced Financial Risk

Utility bonds reduce the financial risk for utility companies when providing services to customers. They can extend services to customers with lower credit ratings or new businesses without as much concern about non-payment.

Improved Cash Flow

With the assurance provided by utility bonds, utility companies can expect more reliable cash flow as the bond issuer is responsible for covering unpaid bills. This enables utility companies to plan their finances more effectively and invest in infrastructure and service improvements.

Increased Customer Trust

For customers, knowing that the utility company requires bonds can instill confidence and trust in the service provider. Customers are more likely to trust a utility company that takes measures to ensure its financial stability and protection against non-payment.

Facilitating New Developments

For commercial developers or real estate projects, utility bonds can facilitate the process of obtaining utility services for the new development. Utility companies may require bonds before providing services to new projects, ensuring the developer’s commitment to paying for utility services.

Avoiding Disconnections or Service Interruptions

Utility bonds help prevent service interruptions or disconnections due to non-payment. If a customer defaults on their payments, the utility company can make a claim against the bond to recover the outstanding amounts instead of resorting to disconnection.

Compliance with Regulations

In some jurisdictions, utility companies are required by law to obtain bonds from certain customers or new developments. Utility bonds ensure compliance with these regulatory requirements.

Promoting Responsible Financial Behavior

Utility bonds encourage responsible financial behavior among customers. Knowing that a bond is at stake can motivate customers to pay their utility bills on time and avoid financial penalties.